Ford GAP insurance

If your Ford is written off, your motor insurer will only pay what they believe your Ford to be worth at the time of loss (aka the "Market Value"). The purpose of GAP insurance is to top-up the amount paid out by your motor insurer to a higher sum. Depending on the type of GAP insurance you have, this could be the settlement figure of your finance agreement, the original invoice price you bought the vehicle for or even the cost of replacing the vehicle with a brand new version of the same vehicle at the time of claim.

5* Customer Service

Our customers saved

On average

£201

At most

£1,647

Largest claim paid

£27,844

Average claim paid

£4,207

Add a little TLCc to your GAP insurance:

Total Loss Courtesy Car

If your vehicle is damaged in an accident, your motor insurance policy will normally provide you with a courtesy/hire car whilst the damage to your vehicle is being assessed.

If they determine that your vehicle is repairable, you would normally have the use of that courtesy car for the duration of the repairs.

However...

If they decide that the damage to your vehicle is beyond repair and subsequently declare it a Total Loss (they write it off), you would then not normally be entitled to their courtesy car any longer (unless you've paid them an additional premium for such entitlement) and, it would be withdrawn: leaving you without the use of a vehicle.

Depending on how much longer they take to settle your claim, you might be without a vehicle for a number of days - or even weeks!

Building in Total Loss Courtesy Car cover (TLCc) to your GAP insurance policy with us, means that in the event your car is declared a Total Loss, we will provide you with a courtesy car for you to use for up to 28-days.

TLCc Cover Features:

The car provided:

- Will be of a similar sized engine to Your vehicle that was deemed a Total Loss (limited to a maximum of a 2.0 litre manual car or equivalent)

- Will be insured. Please note that an excess (normally £250) will apply to accidents/claims occuring during your use of the courtesy car. Exact terms will confirmed prior to you accepting delivery of it.

- Will be able to be delivered to and collected from your home or place of work.

For more information please review the Ts & Cs of our GAP insurance policies here, or generate a quote.

What if your Ford is written off?

To consider what GAP insurance does, it helps to better understand the situation in the event that your Ford is written off without GAP insurance in place, first. Let's look at that:

If your Ford was financed

...your Market Value motor insurance pay-out could well be less than the amount outstanding on finance at the time of claim. If it is, you'd have to pay any shortfall out of your own pocket before you could even think about financing a new vehicle.

However even if your motor insurance pay-out was sufficient to clear most, or even all of the outstanding finance on the now written-off vehicle, how much would you have left over to put forward towards the cost of your next vehicle without needing stump up money from your own pocket?

If your Ford was bought cash outright

...your Market Value motor insurance pay-out is almost certainly going to be less than the price you bought your vehicle for originally. Without GAP insurance in place, you'll only have the amount paid out by your Motor Insurer with which to replace your vehicle. Whilst in theory this should be sufficient to allow you to buy a vehicle of a similar age and condition as was relevant to the now written-off vehicle, if you want to buy a newer, better or otherwise more expensive vehicle, you'll have to fund the additional cost out of your own pocket.

If you leased your Ford

...the finance house will calculate a settlement figure which is normally a combination of what they believe the vehicle to have been worth at the time of loss plus the sum of rentals that you've not yet paid for the remaining duration of the lease. Your Market Value motor insurance pay-out could well be less than the amount of this settlement figure and although some finance houses allow you to walk away from any shortfall, others require you to pay some of it and others still might well require you to pay all of the shortfall.

Just like with a financed vehicle, if you're liable for any shortfall, you'd have to fund that out of your own pocket before you could even think about leasing another vehicle plus, any initial rental required to start a lease agreement on a new vehicle would have to be found too.

This type of cover is the highest level of GAP insurance cover available today. It's a combination of the three main types of GAP insurance: Finance, Invoice and Replacement GAP insurance - which means it provides the best of all cover levels.

In the event of your Ford being declared a Total Loss (written off) through accident, fire, theft, or flood, Replacement GAP insurance aims to pay the difference between your motor insurer's valuation of the vehicle and THE GREATER OF either:

- The amount (if any) outstanding on finance at the time of claim EXCLUDING any Negative Equity brought forward from a previous vehicle (unless the optional "Negative Equity Cover" was purchased), OR

- The ORIGINAL INVOICE PRICE that you paid for your vehicle first time around, OR

- The cost of REPLACING YOUR VEHICLE with a brand new version of the same (or nearest equivalent) as your original vehicle - even if the replacement vehicle cost is MORE than you bought the vehicle for first time around.

For most people who go on to make a claim, having their motor insurer's valuation of the vehicle topped up to the cost of replacing their vehicle with a brand new equivalent at the time of claim by way of a Replacement GAP insurance claim pay-out, would leave them in the position of being able to both clear any outstanding finance and have money left over - more money than they would have had left over than with any other type of GAP insurance - to put towards the cost of their next car.

If you need assistance determining whether this type of cover is suitable for your needs, please contact us.

Invoice GAP insurance is the most commonly purchased type of GAP insurance in the UK today (primarily because it's usually the highest level of cover offered by Motor Dealers). It's a combination of both Finance and Invoice GAP insurance, thereby providing the best of both cover types.

In the event of your vehicle being declared a Total Loss (written off) through accident, fire, theft or flood, Invoice GAP insurance aims to pay the difference between your motor insurer's valuation of the vehicle and THE GREATER OF either:

- The amount (if any) outstanding on finance at the time of claim EXCLUDING any Negative Equity brought forward from a previous vehicle (unless the optional "Negative Equity Cover" was purchased), OR

- The ORIGINAL INVOICE PRICE that you paid for your vehicle when you first bought it.

For most people who go on to make a claim, having their motor insurer's valuation of the vehicle topped up to the original invoice price of the vehicle by way of an Invoice GAP insurance pay-out, would leave them in the position of being able to both clear any outstanding finance and have money left over to put towards the cost of their next car.

If you need assistance determining whether this type of cover is suitable for your needs, please contact us.

If your vehicle is the subject of a Contract Hire / Lease agreement and is declared a Total Loss (written off) through accident, fire, theft or flood your Motor Insurer will pay out only what they think your vehicle is worth at the time of claim.

In the meantime your finance company will have calculated their settlement figure which, would normally be a combination of some or all of the following:

- The amount that the finance company think your vehicle was worth at the time of loss

- The sum of anything up to 100% of the as yet unpaid rentals under your Contract Hire agreement at the time of loss.

- Administration & or penalty fees for wrapping up the agreement early.

Your motor insurance pay-out might well fall short of this figure. If it does your finance company might hold you liable for anything up to 100% of the shortfall and this where Contract Hire GAP insurance steps in... to pay the difference between your motor insurer's valuation of the vehicle and the amount required to settle the remaining balance of your Contract Hire agreement.

In addition, our policies cover up to £3,000 of the initial rental you paid as part of your Contract Hire agreement, meaning that you'd be reimbursed some or all of your initial rental for you to use against the cost of setting up a new Contract Hire agreement on a replacement vehicle.

If you need assistance determining whether this type of cover is suitable for your needs, please contact us.

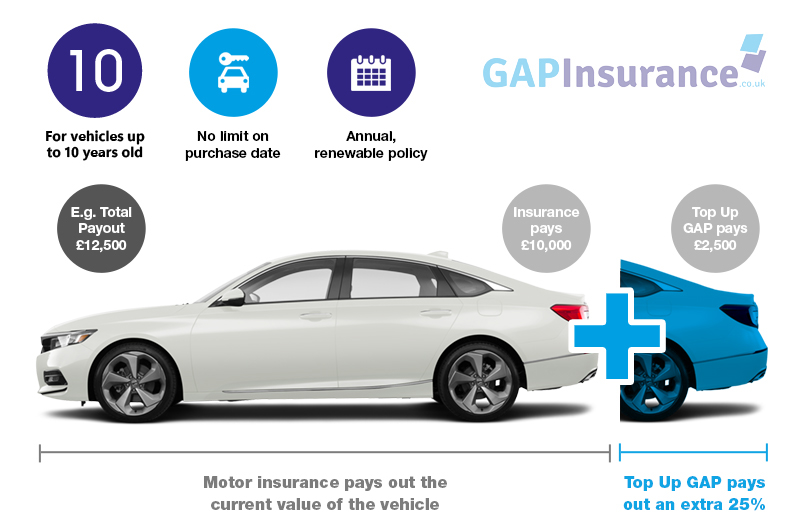

Top-Up GAP insurance is a 1-year long annually renewable GAP insurance policy available for a vehicle up to 10-years old, worth up to £80,000.

It could be a vehicle you bought cash outright, via finance or a vehicle you leased. It could be a vehicle you bought from a motor dealer or a private seller.

It could be a vehicle for which your existing GAP insurance policy is about to expire or, a vehicle that you were expecting to dispose of at the end of your original finance agreement but, you're now keeping for a longer period and you need GAP insurance for that extended period.

If your vehicle is written off, Top-Up GAP insurance aims to top-up your Motor Insurance payout by up to 25%, It will even cover up to £750 of any excess payable to your motor insurance company as part of the Total Loss (write off) claim too!

Am I eligible for Ford GAP insurance?

You can buy GAP insurance for a vehicle that:

- Is covered by a comprehensive motor insurance policy.

- You purchased (or are purchasing) from a Motor Dealer or, are leasing.

- Is less than ten (10) years old for Invoice, Contract Hire and Top-Up GAP insurance or up to 90-days old for Replacement GAP insurance.

- You have not taken delivery of or, you took ownership/delivery of within the last 3 months for Invoice GAP insurance, 90-days for Replacement GAP insurance. You can purchase Contract Hire GAP insurance at any time during your lease, so long as there's a minimum of 12-months left to run on your lease agreement.

- You have NOT changed in any way from the vehicle manufacturer's standard specification, unless the vehicle has been modified for mobility purposes. This would include changes to the bodywork, such as spoilers or body kits, changes to the suspension or brakes, and changes affecting performance such as engine management. Graphics applied to your vehicle are acceptable.

- Has not previously been declared a Total Loss and is not already the subject of a previous incident or existing motor insurance claim which could yet result in it being declared a Total Loss.

- Is registered in the UK.

- Was bought for (or if leased, has a p11D value of) no more than £100,000 for Contract Hire GAP insurance and Invoice GAP insurance, £50,000 for Replacement GAP insurance or, is currently worth less than £80,000 for Top-Up GAP insurance.

- Is not a commercial vehicle. Unless it's a pickup that is owned or leased by a private individual and there is no commercial use whatsoever.

- Is not being used for: rallying, racing, any competitive events, off road (including green laning), emergency services use (blue lights), hire (including private hire, taxis and chauffeur) or for driving school tuition.

- Is not already covered by a GAP insurance policy.

- Was bought cash outright, personal loan (secured or not), or was financed by way of a HP, PCP, Conditional Finance, Lease Purchase agreemet or, acquired by way of a Contract/Lease HireAgreement.

- Is not a specifically excluded vehicle.

- Is not a van, car derived van, motorcycle, motorhome or campervan.

So long as you:

- Are a permanent resident of the United Kingdom (England, Wales, Scotland, Northern Ireland, Channel Islands and the Isle of Man), or a UK registered company.

- Bought the vehicle from a VAT registered motor dealer.

You can NOT buy GAP insurance for a vehicle that:

- Is not covered by a comprehensive motor insurance policy.

- You are not the owner or registered keeper of (Invoice, Replacement & Top-Up GAP insurance) or, you are not named on the lease agreement for (Contract Hire GAP insurance).

- Is more than ten (10) years old for Invoice, Contract Hire & Top-Up GAP insurance or, more than 90-days old for Replacement GAP insurance.

- You took ownership/delivery of more than 3 months ago for Invoice GAP insurance or 90-days ago for Replacement GAP insurance or, where there is less than 12 months remaining on your lease for Contract Hire GAP insurance.

- You have changed in any way from the vehicle manufacturer's standard specification, unless the vehicle has been modified for mobility purposes. This would include changes to the bodywork, such as spoilers or body kits, changes to the suspension or brakes, and changes affecting performance such as engine management. Graphics applied to your vehicle are acceptable.

- Has previously been declared a Total Loss or, is already the subject of a previous incident or existing motor insurance claim which could yet result in it being declared a Total Loss.

- Is not registered in the UK.

- Was bought for (or if leased, has a p11D value of) more than £100,000 for Contract Hire GAP insurance and Invoice GAP insurance, £50,000 for Replacement GAP insurance or, is currently worth less than £80,000 for Top-Up GAP insurance.

- Is a commercial vehicle. Unless it's a pickup that is owned or leased by a private individual and there is no commercial use whatsoever.

- Is (or will be) used for: rallying, racing, any competitive events, off road (including green laning), emergency services use (blue lights), hire (including private hire, taxis and chauffeur) or for driving school tuition.

- Is already covered by a GAP insurance policy.

- Is a van, car derived van, motorcycle, motorhome or campervan.

- Is a specifically excluded vehicle.

Recent Ford GAP insurance claims

Below are a selection of Ford GAP insurance claims that we've paid.

Ford Kuga

- Length of ownership:

- 37 Months

- Rate Of Depreciation:

- An average of £249.96 per month

- Total Depreciation:

- 32.13% of its original Invoice Price during the 37 months it was owned.

- Policy Cost:

- The policy cost £252.03 (2.72% of the amount the policy paid out.)

Ford Fiesta ST

- Length of ownership:

- 23 Months

- Rate Of Depreciation:

- An average of £505.48 per month

- Total Depreciation:

- 42.71% of its original Invoice Price during the 23 months it was owned.

- Policy Cost:

- The policy cost £340.24 (2.93% of the amount the policy paid out.)

Ford S-Max

- Length of ownership:

- 29 Months

- Rate Of Depreciation:

- An average of £52.90 per month

- Total Depreciation:

- 4.49% of its original Invoice Price during the 29 months it was owned.

- Policy Cost:

- The policy cost £177.17 (11.55% of the amount the policy paid out.)

Ford Mustang

- Length of ownership:

- 26 Months

- Rate Of Depreciation:

- An average of £364.81 per month

- Total Depreciation:

- 19.14% of its original Invoice Price during the 26 months it was owned.

- Policy Cost:

- The policy cost £327.77 (3.46% of the amount the policy paid out.)

Ford Mustang Mach-E

- Length of ownership:

- 35 Months

- Rate Of Depreciation:

- An average of £770.00 per month

- Total Depreciation:

- 47.32% of its original Invoice Price during the 35 months it was owned.

- Policy Cost:

- The policy cost £319.34 (1.18% of the amount the policy paid out.)

Had an Ford GAP insurance quote yet?

If you're worried that in the event of write off through accident, fire, theft or flood, your motor insurer's valuation of your vehicle at the time of claim might leave you with a financial burden you could do without – don't be! Our Ford GAP insurance can help to get you back on the road without hitting you in the pocket.

Should the worst happen, a Ford owner with one of our GAP insurance policies can be sure they will not be left with an expensive hole in their finances.

GAPinsurance.co.uk can provide you with the perfect deal to cover your needs - we have a track record in providing specialist GAP insurance cover for Ford cars.

With links to a family firm providing more than six decades of trusted motor insurance services for clients across the country, GAPinsurance.co.uk boasts more than 50 years’ experience among their senior partners alone – meaning you can be guaranteed expert advice when you call on our services.

Get a quote online, to see how we can help keep you on the road.

Caution: certain Ford vehicles are excluded from GAP insurance cover:

Currently excluded Ford vehicles:

Not all vehicles are eligible for GAP insurance. Different underwriters have different risk appetites etc. The following Ford vehicles are currently excluded from GAP insurance cover via GAPinsurance.co.uk.