The reason we don’t pursue the cheapest possible GAP insurance prices from offshore, unrated underwriters (they eventually go bust) just got reinforced that little bit more.

Following hot on the heels of Qudos Insurance A/S in Denmark going to the wall in late 2018 (which itself followed Alpha Insurance A/S (Denmark), Elite Insurance (Gibraltar) and Enterprise Insurance (Gibraltar) who all went the same way since 2016)… LAMP insurance in Gibraltar have now declared insolvency too.

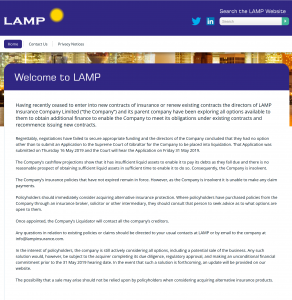

As per the advice published on their website, “Policyholders should immediately consider acquiring alternative insurance protection…”:

Who is affected?

To our knowledge, the only online provider of GAP insurance offering policies underwritten by LAMP was Warranty Direct via their gapcoverinsurance.co.uk website which at the time of posting this, is showing the following message:

The latest news RE: LAMP

LAMP insurance are, “exploring all options, including a potential sale of the business…” – whether they’ll achieve this before May 31st when their application for liquidation will be heard in court, remains to be seen.

What should you do if you have a LAMP underwritten GAP insurance policy?

Your options at this stage would be:

- Do nothing – At this early stage for all we know, it might work out well in the end. LAMP might find a financial solution that allows them to continue trading. Another insurance company might buy the business and permit your cover to remain in force. You might have nothing to worry about and it might be fine should you ever need to claim on your policy with them in the future.

However, *if* you do nothing and you subsequently need to make a claim before LAMP’s affairs are settled, the Financial Services Compensation Scheme (FSCS) will potentially cover you for up to a maximum of 90% of the claim amount.

However *if* you don’t need to make a claim before their affairs are settled and as part of their liquidation your policy ends up being cancelled early and LAMP can’t reimburse you themselves, the FSCS will only be good for reimbursing you up to 90% of what you paid for your policy originally. To be clear, this will leave you without cover and depending on the timescales involved, potentially unable to source GAP insurance cover from elsewhere.

- Seek a refund (or a transfer to a new insurer) from Warranty Direct – The most recent version of the Warranty Direct & LAMP policy wordings that we have to hand, show that unlike most providers who build in a 30-day cooling off period within which you can cancel the policy and get a full refund, they only allow you the statutory 14-day cooling off period.

Whilst this means that you should be able to get a full refund if you bought a policy from them within the last 14 days, if you bought it any longer ago you’re only likely to be eligible for a daily pro-rata rebate and possibly have this subject to their cancellation fee (in the policy wordings we have to hand, this was a surprisingly high £50).

Alternatively, Warranty Direct may be able to arrange uninterrupted cover with another insurer. It’s definitely worth a chat with them – though maybe this time insist that in the advent of now possibly FIVE unrated, offshore insurers of GAP insurance having gone to the wall, you want cover from a more stable insurer next time.

- Seek cover elsewhere – Perhaps the nuclear option but, you bought GAP insurance to protect you in the event of financial loss through your pride-and-joy being written off. Do you really want to be left at worst without cover or at best exposed to the extended delays of trying to make a claim on a policy underwritten by an insurer in the process of being liquidated – an insurer who by their own admission (see screenshot above) are “unable to make any claim payments”?

Our policies for example, are underwritten by a syndicate of Lloyd’s of London – a UK-based A-rated insurer with a considerable legacy and financial resources.

If you bought your vehicle (cash or financed) we can provide cover up to 3-months after you took delivery. If you leased your vehicle (Contract Hire), we can provide cover up to 6-months after you took delivery.

If you’re a customer of Warranty Direct with a GAP insurance policy underwritten by LAMP, we’d recommend that you get in touch with them soonest.

If you happen to be considering GAP insurance from an alternative provider, get a quote from us at GAPinsurance.co.uk or by calling 01484 490095 – discount code “WARRANTYDIRECT” will even save you 10% in the process.

If you have any questions, you can also email support@gapinsurance.co.uk.