What Is Top-Up GAP insurance?

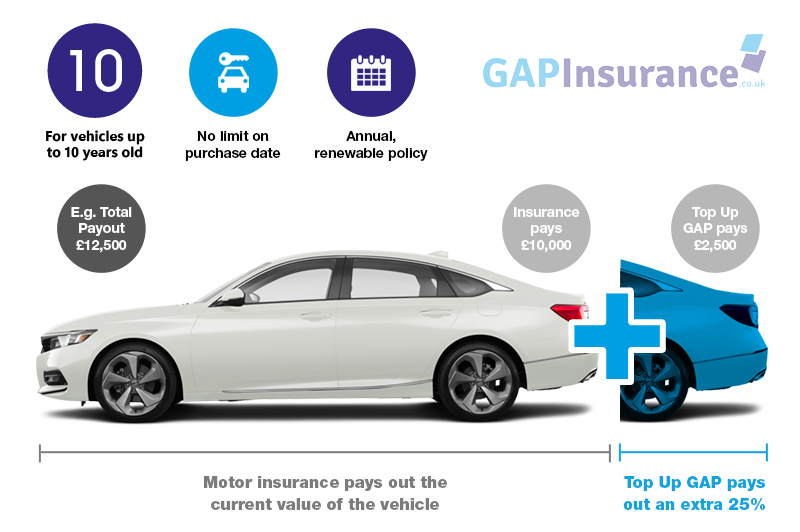

If your car is written off through accident, fire, theft or flood, Top-Up GAP insurance will aim to pay you an additional 25% of the total loss valuation of your vehicle at the time of the incident.

It’s available for cars that (at the time of purchasing the policy) are less than 10 years old. It doesn’t matter how long ago you bought the car or how you bought it, but it can’t be worth more than £80,000.

The policy has a claim limit of £10,000 (e.g. it’ll pay an amount equal to 25% of the total loss valuation of your vehicle or, £10,000 – whichever is the lower).

The policy also provides cover for reimbursement of up to £750 of the excess you pay to your motor insurer for the same total loss claim and, cover can be upgraded to include the provision of courtesy car for you to use for up to 28-days in the event of a total loss, also.